Welcome to the 2021 June Side Income Report.

Let’s start this post with the obligatory caveat:

FLA’s side hustle income reports are not for the purpose of bragging. This side income amount of money is by no means impressive. The sole purpose of this series is to inspire you to create diversified income streams in order to help you achieve your financial goals faster.

I began this tumultuous F.I.R.E. (Financial Independence – Retire Early) journey almost immediately after graduating from college and shortly realizing it is never ideal to work for someone other than yourself.

After withdrawing from the corporate world, I plan to fully indulge in my mission of helping 10 million people with their own path to financial freedom. I’ve discovered a wonderful community of people with shared mindsets. So I’m currently on a journey to see if we can turn FLA into a little business that supports the mission.

The reason I’ve decided to publish these income reports is because I want you to be a part of the journey.

After aggressively saving 70%+ of my annual income year after year, I’m approximately 25% of the way to retirement with 10 years to go. I’m aware that side hustles may never fully support one’s expenses, but I’m willing to try.

At the very minimum of making $1/month (what one may consider failure), I am ecstatic as I realize this can be considered supplemental income that will be able to be reinvested into this blog to enhance your reading experience on FLA.

Through my arduous journey, I’ve learned to focus on the future value of money. One dollar to you may look like a standard George Washington-faced bill, but to me, I see its potential. Accounting for 3% inflation, investing that dollar could return 5 times its original value in 25 years. Yes, that’s like putting $1 into an ATM and having it return a $5 bill back to you. How amazing is compound interest?! Hypothetically, you can increase that principal amount, and you’ve got yourself some unbelievable returns.

My hope with these income reports is ultimately to present some transparency for you. By showing it doesn’t take much effort to earn and save, I may motivate you to chase one of your biggest dreams. Dreams may originally sound outlandish, but they all need to start somewhere, right? Without further ado, here is FLA’s June 2021 Side Income Report.

JUNE SIDE INCOME REPORT

The best way to make money is to have various streams of revenue. The best way to protect yourself in the course of ill-fated events stripping you of some of your main sources of income is to diversify.

We have all heard the pragmatic advice of “Don’t put all of your eggs in one basket.” Well, put this theory into practice. The following is my best attempt to develop additional sources of income. Below are the six ways I attempted to make money from my side hustles in the month of June.

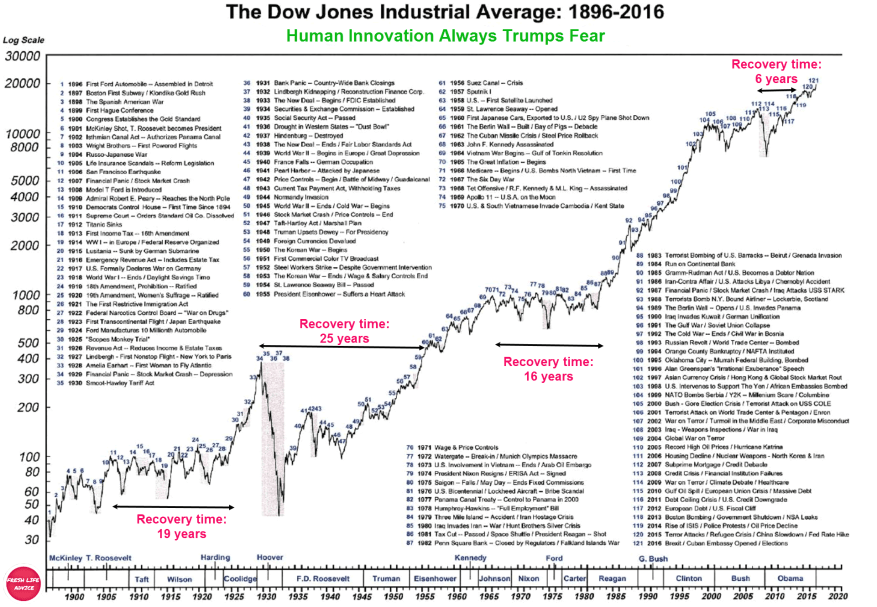

Stocks are my absolute favorite money-making assets. Your money can make money for you with the click of a ‘buy’ button! Sure, there are ups and downs in the stock market, but if you look historically at the S&P 500 Index or the Dow Jones Industrial Average, your investment generally grows over the long term. Remember, investing and gambling are not the same thing.

“If you aren’t willing to own a stock for ten years, don’t even think about owning it for ten minutes.”

-Warren Buffett, American Investor/Business Tycoon/Philanthropist/Chairman and CEO of Berkshire Hathaway

Investors and analysts contend that conducting research on which stock to buy may be active work, but it is a generally held credence that dividends are passive income.

What are dividends?

Simply, they are distribution of some of a company’s earnings to a class of its shareholders. In this case, you are the shareholder. Yes, I know it’s hard to believe, but the company you invest in will reward you with bonus money!

Let’s take a look at the aftermath of the stocks that paid out dividends this month:

Which stocks have I invested in? I have a few individual stock picks, but the finance community knows this is often a loser’s game. I mainly hold VTI, the Vanguard Total Stock Market Index Fund, which allows you to be diversified and capture 3,525 different stocks with a minimal expense ratio, or annual fee, of 0.03%. Index funds will often take you to the promised land in the long run.

Typically, you have 2 choices with dividends. You can either accept the dividend as cold hard cash or you can choose to reinvest the money back into the same stock automatically. It’s as simple as clicking the ‘yes’ button when prompted with the question on whether or not to re-invest dividends.

I strongly recommend you to reinvest your dividends and capital gains. Why? Well, look at this way: you didn’t have the earned dividend money to begin with. Do you really need it at this moment? Why not let your additional money grow even more? Open up an investment account and enjoy the magic of compounding interest by increasing your principal investment.

June Side Income – Stock Dividends / Interest Total: $220.46

In my free time, I participate in paid surveys. It’s one of my other sources of income. The surveys are mindless and allow you to temporarily escape from life’s struggles and reality. Oftentimes, you have a chance to play your part in society and provide meaningful feedback on hot topics that may be decided by top companies and government officials.

The 3 survey programs I use daily are:

I strongly recommend any of these three survey websites because of the higher payouts. Our time on this planet is valuable. Always consider how much time you are trading for money.

Prolific

Prolific seems to have the highest quantity of surveys available. Each survey also previews an hourly rate to the user. This significantly helps in determining if the survey is worth your time. I’ve seen them range from $3/hour all the way up to $30/hour, but on average are $8/hour.

Pinecone Research

Pinecone Research surveys always reward you with $3 for every survey. Since each survey is typically around 10 minutes long, the site has a pretty standard hourly rate of $12/hour. However, the frequency of surveys is much less than Prolific.

Finally, YouGov’s typical survey lasts for 10 minutes and will pay out $1.50, translating to an hourly rate of $6/hr. Even though it is the lowest payout, it still helps to have supplemental income. Again, always consider the balance between time and money.

YouGov is an eclectic group of the media, nonprofits and companies that congregate to find out what the world thinks. YouGov happens to be one of the most-quoted data sources in the US and across the world.

Prolific, Pinecone Research, and YouGov offer all kinds of rewards, but I normally recommend cash payout via PayPal. The transfer is usually instantaneous. Prolific does pay out in GBP, but the money is translated to USD when conducting a bank transfer in PayPal.

In fact, Prolific does not have a minimum payout, Pinecone’s minimum payout is $5, and YouGov’s minimum cash payout is $50, albeit YouGov offers the option of a $15 Amazon gift card.

June Side Income – Surveys Total: $102.71

An additional passive income stream is selling your old goods or unused consumer products. Simply list your items with competitive pricing on Amazon and/or eBay, sit back, and let the buyers make you offers.

I often notice friends, family, and even co-workers constantly looking to throw out items that are still in perfectly good condition; it drives me nuts! Why not let someone bid on the product? Worst case will be that it doesn’t sell, and then you can throw out the item. No harm, no foul.

At the very least, donate your stuff. I typically enjoy donating old apparel to the Salvation Army and other charities. It always feels good to know your treasured clothing is not going to waste.

This month, there was one stranger to bite on an item of my personal inventory I was looking to discard. After fees and small shipping costs, I usually still walk away with a hefty profit.

June Side Income – Selling Total: $25.03

As a blogger, I would like to keep the user experience as clean as possible. Therefore, I have chosen to keep all Google AdSense ads from my website. I am an avid reader of many other blogs, and I can truthfully admit it retracts from the reading experience. I am very proud of this decision and will continue with this route.

June Side Income – Google AdSense Revenue: $0

I published my first eBook titled How I Launched, Marketed, and Promoted a High-Traffic Blog in Under 15 Days last year. I only promoted the book as part of the launch, but several people found their way to the sales page. Again, this is a learning process to convert the views into actual sales. As Robert Kiyosaki alludes to in his book Rich Dad, Poor Dad, it’s all about being a best-selling author, not a best-writing author. There is a subtle yet significant difference.

June Side Income – eBook Blog Startup Manual Sales: $0

Who would’ve ever thought that spending money would actually earn you money? Well, with cash-back credit cards, now it’s certainly possible. With my Capital One Venture Card, I can now make this dream a reality.

Depending on the card you have, you’ll score 1-2 miles with every dollar you spend. Capital One Miles can be used in a variety of ways and are generally worth between half a cent and one cent apiece.

Earn 50,000 bonus miles (equivalent to $500) once you spend $3,000 on purchases within the first 3 months from account opening.

This month I spent more than usual since the Covid-19 restrictions are now being lifted from from most U.S. states. Although I’m still trying my best to limit opportunities to throw away those hard-earned paychecks, the positive result is that I earn more in cash back from the credit card rewards.

After looking at my monthly expense report, I saw that I earned 5,940 miles, which is equivalent to $59.40.

June Side Income – Capital One Credit Card Cash-Back Rewards – $59.40

Well, that’s it for this month’s side income report! Hope your 2021 is going well.

In 2020, I was able to max out my Roth IRA and 401k – I highly recommend you do the same in 2021 if you have the option! In January, I immediately transferred the maximum $6,000 limit from my taxable brokerage account to the tax-deferred Roth IRA for the 2021 year, with most of it invested during a small market pullback at the beginning of March. The sooner, the better since time in the market often beats timing the market.

Thank you for taking the time to read through my latest June income report and thank you for contributing if you have previously purchased something through one of my affiliate links!

If you wish to support this site, but don’t have a need for any of FLA’s affiliate products, you could simply do your regular Amazon shopping through any of the links on this site that lead to Amazon.com. You won’t pay any extra and FLA will receive a small commission. Thanks so much if you do so!

That’s a wrap for this income report! I am looking forward to earning more money on the side in the future. Stay hustlin’, my friends!

Total June Side Income: $407.60

How was your June 2021 side hustling? Let me know in the comments below.

Editorial Note – Opinions expressed here are the author’s alone, not those of any bank, credit card issuer, or other entity. This content has not been reviewed, approved, or otherwise endorsed by any of the entities included within the post.

User Generated Content Disclosure – Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.