Index funds have been touted across the finance world as the proven way to invest hard earned cash. However, the wealthy have turned their backs on passively managed index funds for other types of assets. But why? Why don’t the rich invest in index funds?

Despite popularity, the ultra-wealthy high net worth individuals aren’t as apt to invest in these low-cost funds.

What are Index Funds? What’s the Advantage?

An index fund is a mutual fund or exchange-traded fund designed to follow certain preset rules so that the fund can track a specified basket of underlying investments.

Over the long term, index funds have generally outperformed other types of mutual funds. Other benefits of index funds include low fees, tax advantages (they generate less taxable income), and low risk (since they’re highly diversified).

At FLA, we preach choosing passively managed index funds or ETF’s (i.e., NYSEARCA: VTI or MUTF: VTSAX) with the lowest expense ratios (less than 0.15%) in lieu of picking individual stocks, mutual funds with high fees, or actively managed hedge funds.

Let us dig into the pros and cons of index funds:

Pros of Index Funds

1. Low-Risk

Losing the principal investment is an investor’s worst nightmare. Index funds offer a low-risk option for investing in batch of stocks. They are inherently diversified, representing many different sectors within an index, which protects against deep losses. When one index is performing better than others, the index fund effectively captures these gains that individual stock picking gurus may miss out on.

2. Steady Growth

A central advantage to index funds is that they are designed for steady, long-term growth. The ideal timeline for an investor is to have their money compound forever. No one can predict the future. As a result, having so many stocks in one fund allows for diversification in addition to a self-cleansing system. The dogs are ousted, and the winners continue to ride high.

Index funds are not designed to beat the market, but simply capture the average return. Stock-picking is much harder than one would expect. For instance, U.S. News & World Report noted in 2011 that index funds tied to the Standard & Poor’s 500 (S&P 500) index generated better returns over the previous three years than almost two-thirds of large-cap actively managed mutual funds.

3. Low Fees

Index funds offer lower fees for investors than non-index funds. This means that even when a non-index fund outperforms index funds, it must perform better by a certain margin to generate returns that overcome the management fees that it charges.

Cons of Index Funds

1. Lack of Flexibility

Because index fund managers must follow policies and strategies that require them to attempt to perform in lockstep with an index, they enjoy less flexibility than managed funds. Investment decisions on index funds must be made within the constraints of matching index returns. For instance, if the returns in an index are declining strongly, index fund managers have few options to attempt to limit those losses. In contrast, managers of an actively managed fund have more flexibility to act to find better-performing options in good times or in bad.

2. No Big Gains

An index fund does not carry the potential to outpace the market the way that managed funds can. This means that if you invest in an index fund you are surrendering the possibility of a massive gain. The top-performing non-index funds can perform far better than the top-performing index funds in a given year. However, the top-performing non-index funds may vary from year to year, so those under-performing years can cancel out the over-performing ones, while index funds’ performance remains steadier.

Why invest in VTSAX or VTI?

- Beats 82% of active managed funds

- Expense ratio of 0.04% / 0.03%

- Self-cleansing (companies come and go)

- Tracks the U.S. stock market.

Buy the whole stack, instead of looking for the needles.

Why Are Index Funds So Popular?

A stock index consists of a basket of stocks that is meant to represent something else. Sometimes, this something else is an entire stock market. Other times, this something else is a section of a stock market that serves as a stand-in for either an industry or some other kind of segment.

Whatever the case, it is very common to see interested individuals put their money in an index fund, which is either a mutual fund or an exchange-traded fund that tracks an underlying index.

Index fund investing has become popular since Jack Bogle of Vanguard introduced the Vanguard 500 fund in 1976. The fund tracked the returns of the S&P 500 and marked the first index fund marketed to retail investors.

Index investing is popular for a variety of reasons:

- Index investing is a very passive way of investing, which can be contrasted with more active investment strategies that see individuals buying and selling stocks on a regular basis.

- It’s extremely tough to beat the market in the long run. Once taxes and trading costs are incorporated into calculations, the index funds prevail.

- There is empirical evidence that shows actively managed funds consistently underperform in the long run.

- Index investing is a very useful way for investors to protect themselves from non-systematic risks through means of diversification. This is due to the fact they have spread out their money rather than concentrate it in the stocks of a small number of companies.

- Individual stock picking can be time consuming. Many hours of research are required before an investor has truly educated opinion on whether to invest. Index funds a practical solution that reduces the necessary time and effort.

Unless you have the knowledge, time, and patience to vet each individual company you’re considering before buying its stock, you could wind up with a portfolio that’s weighed down with bad deals and underperformers. That’s one reason why many investors tend to appreciate the beauty of index funds.

Fees Add Up

When you invest in any mutual fund, you pay a set of annual fees that add up to its expense ratio. In exchange for the actively managed fund’s cost, you are getting the expertise of a seasoned fund manager. The manager and their team will assemble a well-researched collection of stocks, put it into a neat package, and shift the fund’s holdings when they see that as a smart idea.

That doesn’t come cheap.

With index funds, by contrast, most of that work (and pricey expertise) is not necessary, so their expense ratios can be as little as one-tenth of what you’d pay for an actively managed fund. But despite the many benefits of index funds, they aren’t particularly popular among wealthy investors.

Why the Rich Tend to Look Elsewhere

Index funds are an extremely cost-effective, convenient investment choice. But they generally aim to match the performance of their associated indexes, not surpass it. The ultra-wealthy, however, may not be satisfied with that.

Instead, they turn to other money-making assets, such as private equity, art, and even IPO’s. These investments are often far riskier than your average index fund, but they have far greater upside potential. The wealthy can take on this risk because they can still get back on their feet, even after losing a relatively large sum of money. The middle and lower classes do not have this luxury.

Let’s walk through a scenario.

Imagine that you have $500,000 invested in stocks in your tax-advantaged retirement accounts. That’s probably a lot of cash for you. If your portfolio declined in value by half, or worse, it could have a major impact on your future quality of life.

But, for example, someone with an investment portfolio worth $50 million could suffer a major loss and would still be left very relatively wealthy. That allows them the freedom to take on more risk than the average retail investor would be comfortable with.

The rich can pursue high-risk, high-reward investment opportunities without worries because their wealth can make for a very effective cushion from such problems.

In fact, wealthy investors often favor actively managed mutual funds. Their iffy odds of delivering that sought-after outperformance can be overwhelming appealing despite the higher fees. The large majority of actively managed funds won’t beat the market, and over multi-year periods, the share of them that do, drops even further. By contrast, index funds often outperform active funds across different asset classes.

Other Assets

The wealthy also can more easily invest in real estate, antiques, and other less-liquid assets — whereas you probably can’t afford to take on the risk associated with buying a $100,000 piece of art you hope will appreciate in value. And in the “actively managed” sphere, the wealthy also have the ability to put money into hedge funds, which most of us are legally barred from.

In order to protect normal people, the SEC has created all sorts of rules and regulations for how companies that invest money on behalf of other people should operate. While this makes the investments safer and less volatile, it prevents the firm making investments from chasing riskier but possibly more profitable investments.

Hedge funds are not allowed to have more than 100 investors, and they are not allowed to take on any investors with less than $1 million in wealth.

The goal of hedge funds is to earn absolute returns. What this means is that they make money every year, regardless of what the stock market does. A few funds have done this, but 2008 demonstrated that most funds were bluffing in saying they were able to do that, and many of them went out of business.

Why Don’t the Wealthy Invest in Low-Fee Index Funds?

They sometimes do. But it is also easier to buy individual stocks when one is investing large sums.

Also, many wealthy people have business experience which gives them insight into economic trends and specific companies. This leads them to buy individual stocks. Whether they perform better than the indexes is not assured.

A majority of the wealthy seek for Alpha. The finance world defines Alpha (α) as excess or abnormal return over a benchmark index.

In addition, they want to diversify their portfolio across asset class and earn underlying performance return, which is different from an index fund. This has resulted in huge investment growth in the following:

- Portfolio Management Service (PMS)

- Private Equity

- Structured Products

- Hedge Funds

- Art

- Real Estate

The wealthy use these investment vehicles because there is a barrier to entry with high entrance costs. These risky investments generally require large buy-in costs and carry high fees, while promising the opportunity for outsized rewards.

High Risk, High Reward

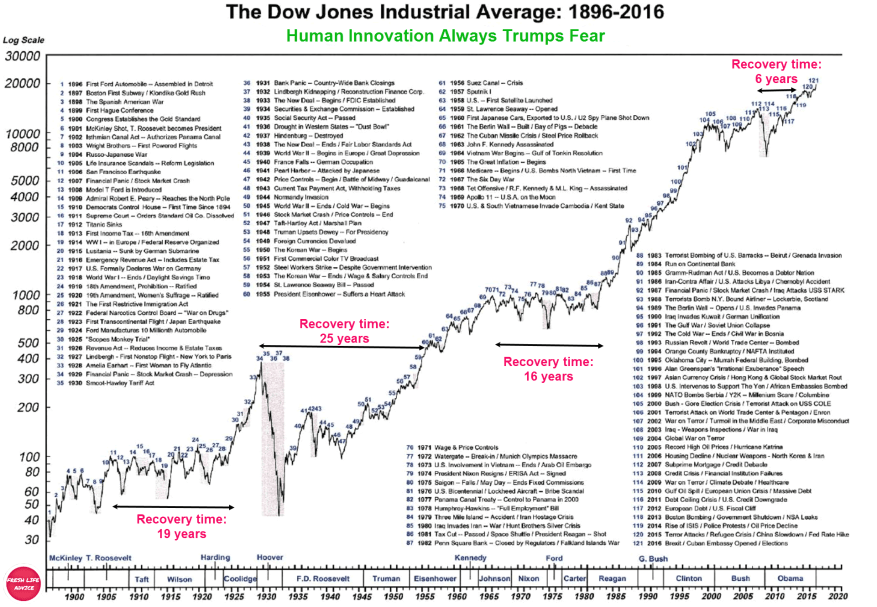

Over the past 90 years, the S&P 500 averaged around a 9.5% annualized return. You’d think the rich would be satisfied with that type of return on their investments. For example, $10,000 invested in the S&P 500 in 1955 would be worth more than $3 million at the end of 2016. Investing in the whole market with index funds offers consistent returns while minimizing the risks associated with individual stocks.

But the wealthy can afford to take some risks in the service of multiplying their millions (or billions). For another example, look at world-famous investor and speculator George Soros. He once made $1.5 billion in one month by betting that the British pound and several other European currencies were overvalued against the German Deutsche mark.

Hedge funds aim for those sorts of extraordinary gains, although history is filled with examples of years when many hedge funds failed to outperform the stock market indices. But they can also pay off in a big way for their rich clients. That’s why the wealthy are willing to risk hefty buy-in fees of $100,000 to $25 million for the opportunity to reap great returns.

The one percent’s investing habits also tend to reflect their interests. As most wealthy people earned their millions (or billions) from business, they see this path as a way to continue maximizing their finances while sticking to what they know best — corporate structure and market performance.

For that matter, the rich can sink their money into luxuries such as art pieces, sprawling real estate properties, cars, and other collectibles. In this case, they can enjoy grandeur while still benefiting from their increase in value over time. By buying these luxuries, the wealthy not only enhance their lifestyles but also enjoy the value appreciation as a nice bonus.

How the Wealthy Invest

As an example, let’s look at the former CEO of Microsoft, Steve Ballmer. He holds a net worth of about $84 billion in 2021. Even after walking away from Microsoft, Ballmer owns over 300 million shares in the company. This alone translates to a multi-billion-dollar investment.

Some of the other ways Ballmer chose to invest his money included:

- A roughly 4% stake in Twitter (before he sold his shares in 2018)

- Real estate investments in Hunts Point, Washington, and Whidbey Island

- Purchase and ownership of the Los Angeles Clippers basketball team for $2 billion.

The rich can make huge investments in the industries that catch their interest, as shown by the numerous businesspeople who have winded up buying sports teams of one kind or another.

Ballmer’s wealth is concentrated in a handful of investments. This is a far cry from the hundreds of investments that come with Buffett’s and other personal finance gurus’ recommendation of buying low fee index funds.

Hedge funds are likewise popular with the wealthy. These funds of the rich require investors to demonstrate $5,000,000 or more in net worth! The sophisticated strategies intended to beat the market are the allure of the funds. But hedge funds charge approximately 2% of fees and 20% of profits. Investors need to get huge returns to support those high fees!

This isn’t to suggest that the wealthy don’t own traditional stocks, bonds, and fund investments—they do. Yet, their riches and interests open doors to other types of exciting and exclusive investments that aren’t typically available to the average person.

The Bottom Line

It is true that the wealthy have many opportunities not readily available to the middle and lower class. But this doesn’t necessarily mean they are guaranteed higher rates of return. They won’t always beat index funds, but they more often than not can afford to take on this risk. All in all, they are less dependent on steady growth and returns.

Warren Buffett might be the world’s most famous investor, and he frequently touts the benefits of investing in low-cost index funds. In fact, he’s instructed the trustee of his estate to invest in index funds.

“My advice to the trustee couldn’t be more simple: Put 10% of the cash in short-term government bonds and 90% in a very low-cost S&P 500 index fund.”

-Berkshire Hathaway’s 2013 annual letter to shareholders

If a simple, straightforward low-fee index fund is good enough for Warren Buffett, then it’s certainly adequate for the average investor.

Even though index funds aren’t popular among the very rich, they’re still a great choice for the everyday investor. If that’s the category you identify with, you’d be wise to add some to your portfolio. They may not make you rich overnight. However, by capitalizing on the broad long-term gains of the U.S. market, you could accumulate quite a substantial sum over time and achieve your own financial goals.

Disclosure: Fresh Life Advice is an opinion-based website. I am not a financial advisor, and the opinions on this site should not be considered financial advice.

Personal Capital: The Ultimate Tool to track your Net Worth, Budget and more.

What is your investing strategy? When do you know it’s the right time to buy or sell a stock? Let me know in the comments below.