Many of us would like to build enough capital to prepare for the future and enjoy an early retirement. However, this can feel impossible at times. What are the 5 foolproof steps for early retirement? How do we develop a solid plan?

Fortunately, there are some easy steps you can start taking today to help you achieve the F.I.R.E. (Financial Independence Early Retirement) you’ve always dreamed of.

There are no secret tricks and tips. It mainly stems from discipline and consistency. You don’t need to be a Wall Street investment banker or a PhD scientist to outsmart the market. Here are 5 simple steps that will put you on the right path.

1. Increase Annual Savings

Everyone has heard the trite advice of forgoing the precious cup of morning coffee at your favorite hip coffeehouse to save money. This simply isn’t going to get you to retirement though.

You need to build habits of saving. Let me let you in on a little secret; successful people do not have greater will power and determination than your average Joe. The high achievers just remove temptation and practice consistent habits.

Save as much as you possibly can now, and I promise you will not be disappointed by the results in 10 to 30 years from today.

2. Decrease Annual Expenses

It may seem like common sense, but so many of us struggle to grasp this basic concept. Expenses add up very easily and very quickly. It’s important you perform monthly audits of your credit card statements to see how your spending has changed month to month.

It is okay to splurge every once in a while, but be sure to not make it a habit. It’s the same idea of eating healthy. You can stop by the fast food drive-through once in a blue moon, but if you continually practice this bad habit, you will gain weight without a doubt.

Furthermore, avoid consumer and other forms debt like it’s the plague. Even if you are indeed in debt, it’s still easier than you think to rid yourself of debt with the power of positive habits. Again, it may be daunting to turn your net worth from negative to positive, but if millions have done it before, so can you.

3. Make Steady, Consistent Investments

Now, there are some factors here that you have little control over.

Investment Growth Rate: How much your investments compound annually.

Investment growth rate is sometimes at the mercy of the stock or housing market, depending on the year. But overall, you can expect a rate of approximately ~6-7% (with inflation accounted for). Your income from your job may not increase much year over year, unless you pester your boss for a raise or a bonus.

Your neighbor, your co-worker, and even your family may argue with you about which stock will provide the best returns, but one thing is for sure:

Time in the market is way more important than timing the market.

Investment and financial analysts will always recommend buying low and selling high, but the truth is, humans simply aren’t robots. We will never be able to flawlessly invest, but we can get the best bang for our buck by letting our investments grow for as long as possible. Let your money do the heavy lifting for you.

Even our cute friend, Raven, can predict stocks better than some money managers that possibly bring home a larger annual salary than both you and I.

4. Diversify Income Streams

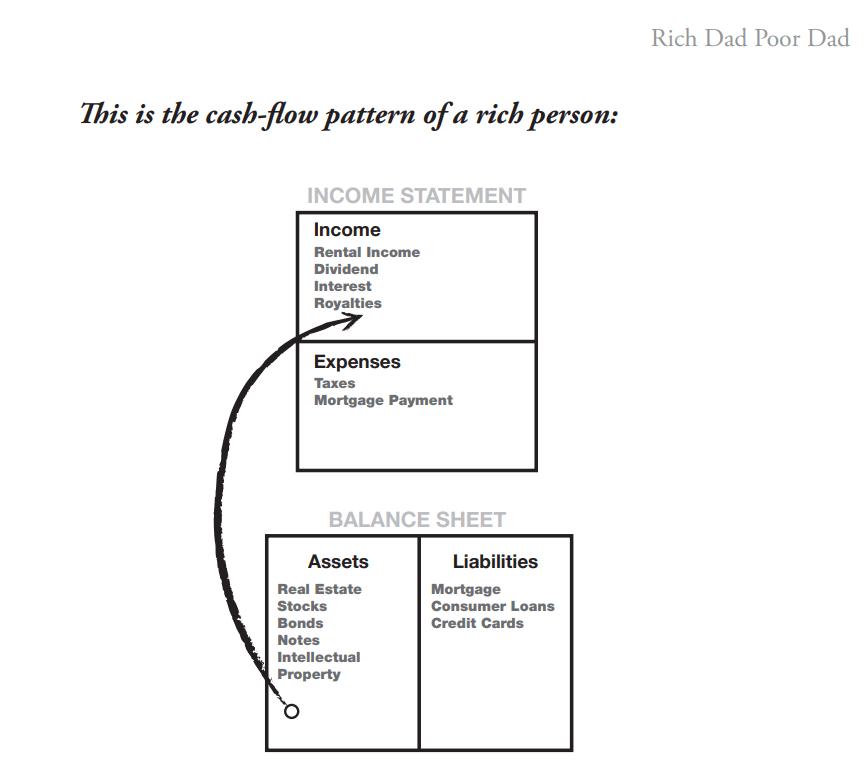

The wealthy often have multiple streams of income. Whether this is from stocks, real estate, I.O.U.’s, or even intellectual property, the rich know how to maximize cash flow going into their bank accounts.

The book Rich Dad Poor Dad by Robert Kiyosaki is a great fundamental novel that goes into detail regarding assets (things that make you money) and liabilities (things that lose you money).

Although we will not get involved in judging Kiyosaki’s character and other ventures, the financial community can agree the book is a vital tool to launch your net worth in the right direction.

Feel free to check out Fresh Life Advice’s Monthly Side Income Reports to see the current ways F.L.A. creatively supplementing a corporate paycheck. Again, there is no one-size-fits-all formula to follow, but hopefully this can supply you with myriad ideas to implement in your own life.

5. Use Money to Save Time

Ask yourself, “Self, what is truly the point of early retirement?” To most of us, the purpose of early retirement is to use our time for the things we truly care about. There is no doubt about it; we all have limited time on this Earth. That is the limiting factor that puts the rich and the poor on the same level playing field. What is the difference between the rich and the poor?

Well, the rich are using their hard earned money (or lucky inheritance) to buy back time for the things that truly matter in life: family, friends, hobbies, etc.

The poor, along with a great deal of the middle class, misleadingly think that spending their money on impractical status symbols, such as fancy watches, luxurious cars, and excessive wardrobes will make other people admire them more, and thus increase their happiness. This is, of course, a fallacy as we know that most people only really care about themselves and are often too busy with their own problems to be concerned with what car you drive.

For example, the modern wealthy folks now spend money on nannies, gardeners, maids, and other services that allow them to focus less on daily household chores and more on the mysteries and life experiences that awaits them.

Why Should You Have a Plan?

“Everybody has a plan until they get punched in the mouth.”

-Mike Tyson, Former Heavyweight Boxing Champion

To the contrary, Fresh Life Advice has a formidable rebuttal to this famous opposing quote. F.L.A. would like to emphasize the importance of planning – specifically the right kind of planning. Everybody does have a plan until they get punched in the mouth — the key is planning for what you are going to do AFTER that happens.

One of the biggest reasons why I created a blog was to organize my thoughts coherently and offer advice to the general public. Again, I don’t claim to know more than you. I just hope you learn at least one new thing from me. Moving to different states and taking several different jobs, I’ve run into eclectic groups of people. Oddly enough, I observed that there was a constant underlying accepted corporate dogma.

People in the public and private sector both seemed to accept the standard way of life was to work until you’re 65 and then retire. This antiquated way of thought was hardwired into their brains either via their parents, boss, coworkers, etc. At times, I often felt like I was alone until I reached out to the finance blogging community. FIRE is becoming a modern mantra.

The first law in the United States that called for an eight-hour work day was passed in Illinois in 1867. In 1926, as many history lovers know, Henry Ford — possibly influenced by US labor unions — instituted an eight-hour work day for his employees.

Now, we can see this divergent fork in the road caused by the Covid-19 global pandemic. The world’s workforce is now being split up into employees who can work from home and essential employees who must physically be present in the office, warehouse, hospital, etc.

Many predict that in the future, the office will function as a 3rd space (similar to your favorite coffeehouse): a hub, a town square, a neighborhood. Workers will decide when, how and where to work. People will flow in and out. Employees will be connected by social networks, cloud computing.

Which side of the spectrum will you end up as technology and artificial intelligence develop at an aggressively rapid pace?

If there’s anything that life and Darwin have taught me, the answer is simple: you must not only survive but also adapt.

So what does this all have to do with money?

Well, my point is that the world is a scary and unpredictable place. Most people enjoy their 9-5 jobs because it gives them the comfort and security they long for to help them sleep at night. I’m here to tell you it’s possible for a normal human, just like you and me, to leave the workforce way before age 65. In fact, I’m on pace to retire by age 38. Even if I miss that mark by a full 10 years, I’m still on pace to retire a full 27 years earlier than the average American! That’s an incredible amount of time of freedom.

Is This ‘5 Foolproof Steps Early Retirement’ Plan Actually Foolproof?

Of course not. No plan ever is. But I can assure you it’s pragmatically close to flawless.

Life almost never goes according to plan. And that’s totally okay. We will adjust and adapt.

Many fear an economic downturn or recession. Well, I’m here to shed some light on this fear.

Economic recessions [bear markets] generally do not last as long as expansions [bull markets] do. Since 1900, the average recession has lasted 15 months while the average expansion has lasted 48 months. The Great Recession of 2008 and 2009, which lasted for 18 months, was the longest period of economic decline since World War II. If this happens, buy stocks or bonds at the cheaper price and retire a year later. There is nothing to fret!

The most important thing is to have a plan though. Be intentional with your thoughts and actions. It’s time to stop being reactive and start being proactive. Where’s a great place to start?

Well, think about your own retirement age. What age are you aiming for?

If you can control these 3 factors, you will be in GREAT shape:

Income: How much money you are making

Expenses: How much money you are spending

Savings: How much money you are saving

When people mention Savings Rate, they are simply referring to your Savings divided by Income. Don’t let terms like these confuse you.

Sounds obvious, right? It’s not rocket science, but Wall Street often makes it sound like it. There are only two ways to do increase your savings rate: earn more or spend less. That’s the basic rule of personal finance. Still, Americans significantly struggle with these aspects. F.L.A. will show you specific action plans to increase your savings rate.

Caveat:

Be ready for backlash when revealing your early retirement plan to friends, family, and loved ones. Even the people closest to you and the ones that you trust the most may project some negative feelings onto you. It’s completely normal.

“Don’t ever let someone tell you, you can’t do something. Not even me. You got a dream, you got to protect it. People can’t do something themselves, they want to tell you you can’t do it. You want something, go get it. Period.”

― Pursuit of Happyness

Will Early Retirement Guarantee Happiness?

Humans are terrible at predicting future happiness. In fact, there was actually a scientific study conducted by three established psychology university professors to prove this “end of history illusion.” No matter what age, humans underestimate how much they will change. Two different studies were conducted:

- A group of 18-year-olds was asked to predict what their lives will be like in 10 years. The 28-year-olds group reported significantly more changes than expected.

- This exact experiment was then conducted with 58-year-olds and the same result occurred when the subjects turned 68.

Conclusion:

Even with plenty of life experience, you have no idea what will happen to you in 10 years!

As a result, it is imperative that you have a plan in place to at least guide you in the direction you would like to follow. But more importantly, remember to practice gratitude and count your blessings every single day, because you never know what your future holds.